Collections Account Closed

One of the good things about your credit report is that negative information and closed accounts are deleted so that you can rebuild damaged credit history. The debt now belongs to someone else so it would be pointless to pay the original creditor.

How To Remove A Closed Account From Your Credit Report Us News

For example a credit card holder may choose to close their account if they no longer use the card have fears of identity theft or have financial hardship.

Collections account closed. You can dispute any other inaccurate information regarding the closed account like payments that were reported as late that were actually paid on time. I think this depends on what you mean by a closed account. You cannot reverse the process of an account going to collections but you can rectify it by settling the balance owed.

I checked my credit report for the first time and there is a 75 collections account by TRANSWORLD earlier this year that I know nothing about. There you can ask the creditor to validate the debt they claim you owe or choose the reason you believe the. When you overdraw your bank account and fail to settle the debt your bank can close the account and send the debt to collections department.

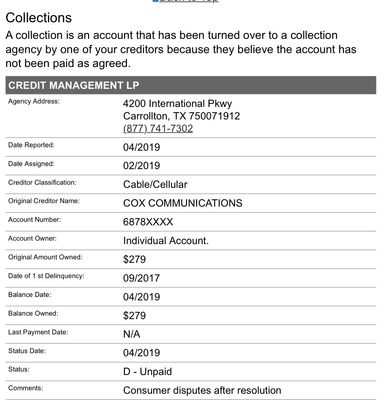

A closed status of a collection can mean various things but in each case it broadly states that collection on the debt is currently not active. A closed account with late payments in its history will be deleted seven years from the original delinquency date of the account. Once an account is sold to a collection agency the collection account can then be reported as a separate account on your credit report.

A closed collections account is different from any other closed account at least where your credit report is concerned. It said it was on behalf of Quest Diagnostics so I called Quest Diagnostics. The account may still be sold to a debt buyer.

In fact both accounts closed in good standing and negative items or collection accounts may remain on your credit report for seven to 10 years. A collection account on your credit can lead to a significant drop in your credit scores. Closed accounts still contribute to your credit age and they continue to age even after they are closed.

You can dispute closed accounts that are not reporting correctly. If its open meaning unpaid with a balance still due it might update every month. If you stop paying your debts after a period of time typically 6 month the lender usually closes the account for further payments writes it off and sell it to collection agencies or files a law suit against you.

The effect of account closure on your credit depends on multiple factors including the amount of available credit youre using the length of your credit history the status of the closed account and the accounts that are still open. The most common meaning is that the debt collector no longer has active authority to continue collection on the debt. FICO looks at them the same for scoring purposes at first.

Paying the past-due amount to the lender before it is sold may prevent a collections account from being reported on your credit. They said it was for an. According to Equifax closed accounts with derogatory marks such as late or missed payments collections and charge-offs will stay on your credit report for around seven years.

A closed account in bad standing. A credit account may be reported as closed for a variety of reasons. One collection company responded in February 2018 stating that the account has been closed with their agency.

Closed accounts can still have a powerful impact on credit scores. A credit bureau could mistakenly report an open account as closed. In contrast secured loans such as mortgages or auto loans that default would.

Continue paying off accounts that were closed with balances to prevent them from going to collections. Having a credit account reported as closed when its actually open could be hurting your credit score especially if the credit card has a balance. Itll take seven years for accounts that have gone to collections to fall off your credit reports.

You requested a credit account to be closed. Banks must notify you before any accounts are sent to collections. If its something that went into collections the account stays on your report for a specific amount of time from the first delinquency.

You can initiate disputes and removals either in writing by mail or electronically on the bureaus website. The account balance is wrong. After the collection account disappears your credit score might improve.

A closed credit account is no longer active meaning that no future transactions can be processed. How a closed account might affect your credit. Answer 1 of 5.

You paid off or refinanced a loan. You should highlight all of them. Is a collection account different than a charge-off.

The online method is the quickest way to file a dispute. The impact on your credit score is probably already lessened. Having a closed collections account on your report rather than a closed account in good standing may be a red flag to most lenders who assume that you are irresponsible with credit.

Its closed after its paid. Basically a collections account is open if it is unpaid. Your creditor closed an account due to inactivity.

Collections can appear from unsecured accounts such as credit cards and personal loans. Unless you go through a Credit Repair company who can remove it sooner. When this happens the account status changes to Closed.

Here are a few things to watch out for when an account is closed. Your creditor canceled an account because of delinquencies. The collection account is listed as installment revolving or 120 days late These are terms used for non-collection accounts and should not appear with any collection account.

After seven years most collections accounts should fall off your credit reportso if youre closing in on seven years just hang on. Closed accounts with a paid as agreed status on the other hand can stay on your credit report for up to 10 years from the date the lender reported it as closed. If you already have an account in collections meaning the original creditor has already closed your account and transferred it to another owner you should not pay the lender that the loan was originally from.

The account is not really in collection. And if the account has been reported to a credit reporting agency they will submit a request for the to account to be deletedShould I contact TU Equifax. Notate the discrepancies along with the collection accounts you would like removed.

Even after closing an accountlike a personal loan or credit cardthe information related to your balances and payment history stays on your credit report for many years. A charge-off means the lender or creditor has written the account off as a loss and it is closed to future charges. Once your overdue debt is handed over to an internal or external debt collector this action probably will pop up on your credit reports.

Collection accounts have a significant negative impact on your credit scores. If its a credit account that. Common errors with collection accounts include.

What do I do about a 75 closed collections account that showed up on my credit report. It cant be taken off early and it cant be reopened. For someone doing a manual review of your account say for a mortgage or apartment lease they will want to see it paid.

Bank Account Closing Letter Format Sample Cover Templates Cancellation Cartas

Large Self Inking Account Closed Stamp In 2021 Accounting Stamp Self

Credit Power Respect Home Facebook

Account Is Closed Blackberryjelly Instagram Photos And Videos Doodle Books Doodle Art Letters Doodle Illustration

Collections Listed On Crs As Closed Account Instea Myfico Forums 5586124

Frazier Credit Solutions Collections Account Removed Facebook

Simmons Financial Solutions Llc Home Facebook

Preopenmarket Preopen Market Today 20 02 2020 Dhaval Malvania Marketing Business Pages Stock Market

How To Read A Credit Report From Credit Karma Finivi

The Truth Should You Never Pay A Debt Collection Agency Solosuit Blog

Posting Komentar untuk "Collections Account Closed"