Collections Of Accounts Receivable Are Recorded In The

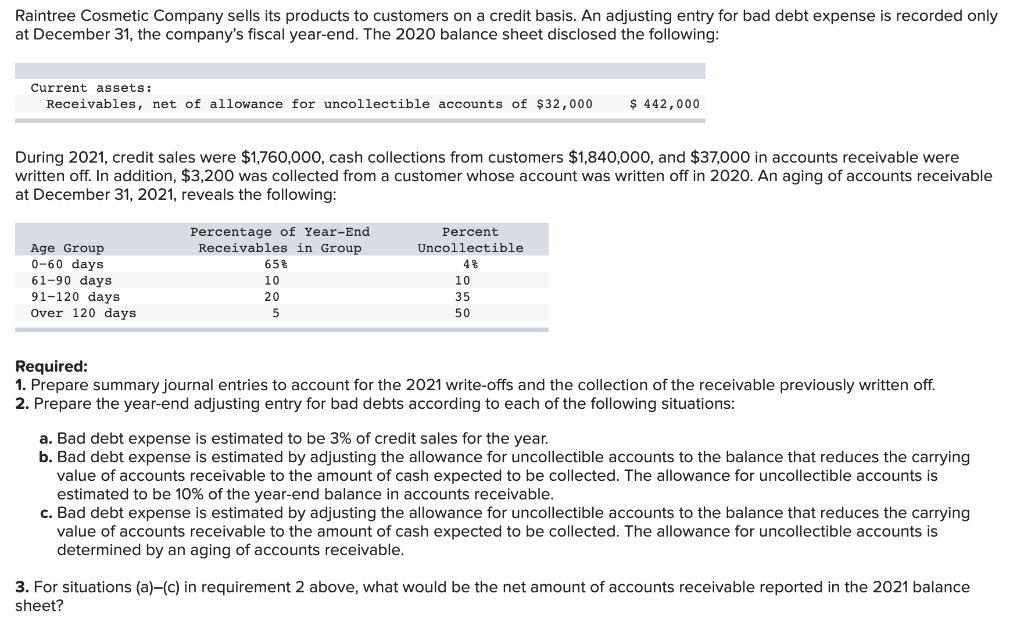

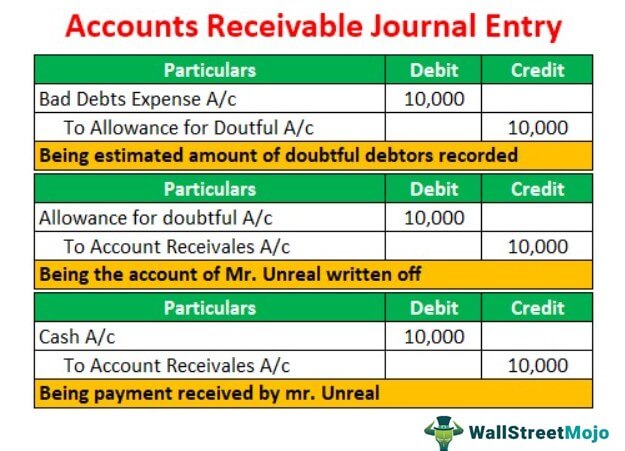

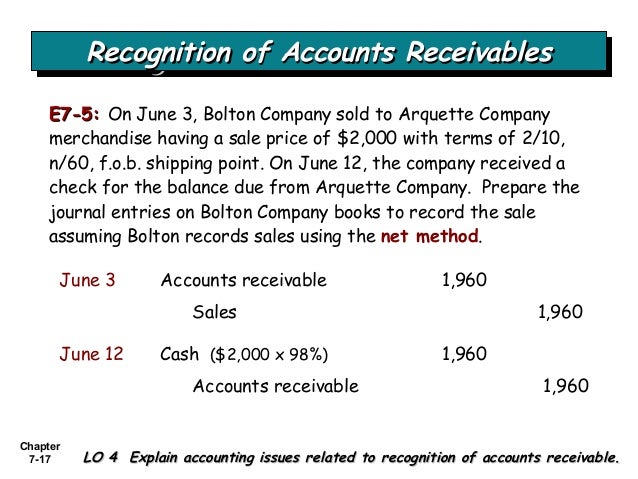

When the allowance method is used to record the bad debt expense the expense is recorded as an adjusting entry and write-offs and recoveries of accounts receivable during the period are all. The sales on the credit side are increased and accounts receivables on the debit side also increased.

Account Receivable Collection Journal Entry Double Entry Bookkeeping

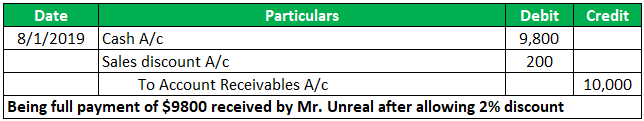

When an account receivable is collected 30 days later the asset account Accounts Receivable is reduced and the asset account Cash is increased.

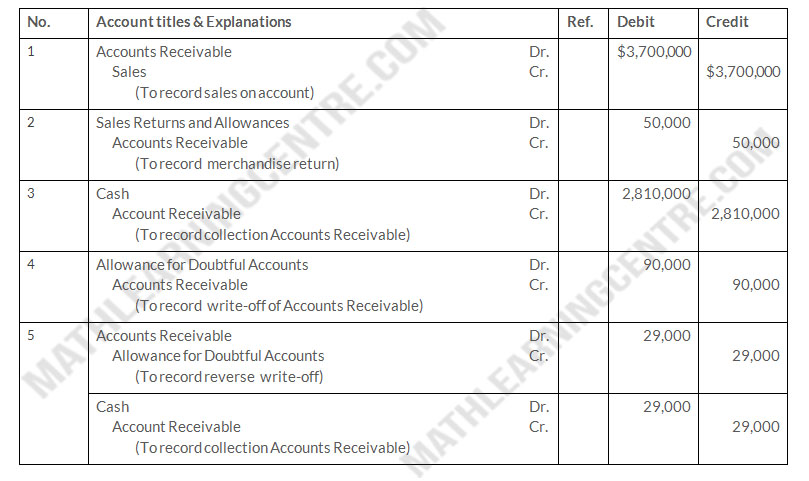

Collections of accounts receivable are recorded in the. This cash is allocated to the customer invoice and the balance on the account is cleared. Record accounts receivable when services are performed or supplies or properties are sold. And then we can record the collection of accounts receivable with the debit of the cash account and the credit of the accounts receivable to record the cash collected.

Accounts receivable is any money your customers owe you for goods or services they purchased from you in the past. Generally speaking net income is revenues minus expenses Under the accrual basis of accounting revenues and accounts receivable are recorded when a company sells products or earns fees by providing services on credit. Percentage of accounts receivable arising during certain seasons.

Under the accrual basis of accounting revenues and accounts receivable are recorded when a company sells products or earns fees by providing services on credit. For effective collections your business will want to create a report that tracks and measures the payment status of all your customers. Credit to Cash and a debit to Accounts Receivable D.

DCredit to Cash and a debit to Accounts Receivable. The collection of accounts receivable is recorded by a. Restate the accounts receivable to the balance sheet.

The amount due from the customer is called accounts receivables. 1 The collection of accounts receivable is recorded by a. Other collections are recorded when.

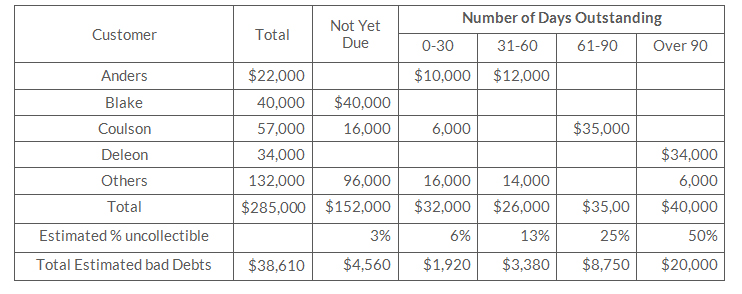

Generally speaking net income is revenues minus expenses Accounts receivable is recorded on your balance sheet as a current asset implying the account balance is due from the debtor in a year or less. This aging report will direct and inform your collections efforts. Collection of accounts receivable previously written-off requires two journal entries.

The amount is credited to the accounts receivable account of the customer to record the fact that the cash has been received from them. Accounting Equation for Account Receivable Collection Entry. Credit to Cash and a credit to Accounts Receivable B.

CDebit to Cash and a credit to Accounts Receivable. A Debit to Cash and a debit to Accounts Receivable. Accounts Receivable and Collections Policy and Procedures Page 8 of 37 328 Ensure that customers that are not or are no longer eligible for credit that payment in advance has been secured before receiving any future services.

This money is typically collected after a few weeks and is recorded as an asset on your companys balance sheet. Debit to Cash and a debit to Accounts Receivable. Records collection losses based on companys collection experience - Estimate Bad Debt Expense - Allowance for Doubtful Accounts AFDA.

The collection of an account receivable is recorded by a debit to Cash and a credit to Accounts Payable. BCredit to Cash and a credit to Accounts Receivable. Number of times the average balance of accounts receivable is collected during the period.

A Debit to Cash and a debit to Accounts Receivable. The corresponding amount equivalent to accounts receivables are recorded as sales. 329 Transfer receivables recorded in their accounts receivable software to the Collection Agency.

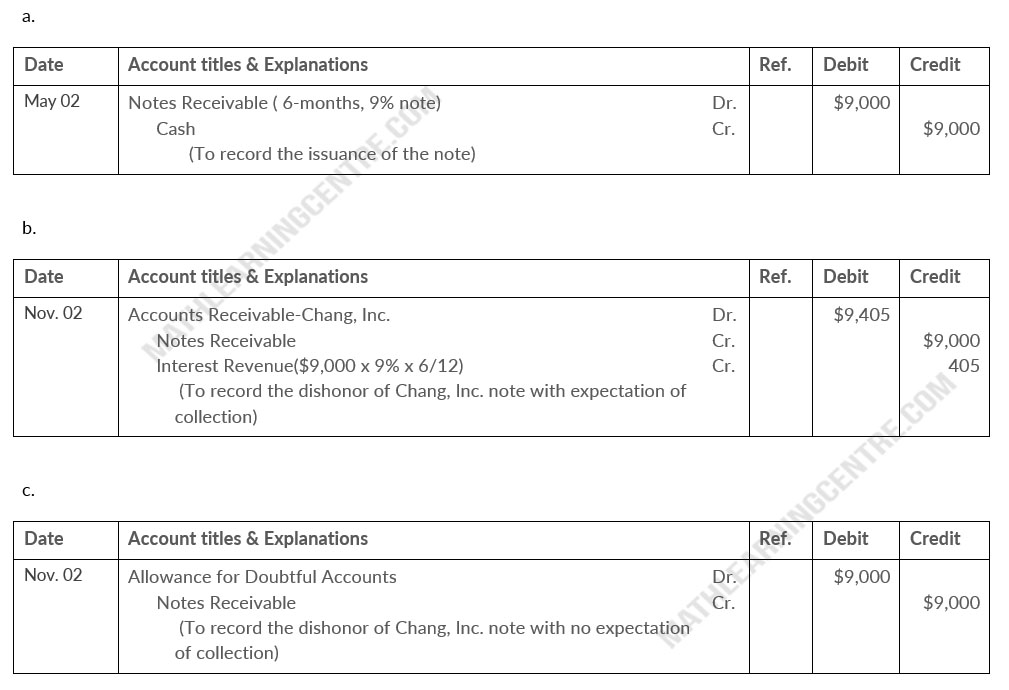

Furthermore accounts receivable are current assets. 1 Journal entry to restore accounts receivable and the corresponding balance of allowance for doubtful accounts 2 Journal entry to record the collection of accounts receivable Journal entry to restore accounts receivable and allowance for doubtful accounts. D Credit to Cash and a debit to Accounts Receivable.

43 In accounting the terms debit and. It is popularly called Trade Receivables and it is a current asset. This includes items paid and collected through the Treasury lntra-governmental Payment and Collection IPAC system or other billing method outlined in the inter-agency agreement.

B Credit to Cash and a credit to Accounts Receivable. The rules of debit and credit may be summarized as follows. C Debit to Cash and a credit to Accounts Receivable.

Companies record accounts receivable as assets on their balance sheets since there is a legal obligation for the customer to pay the debt. Percentage of accounts receivable turned over to a collection agency during the period. 42 The collection of accounts receivable is recorded by a.

When sales are made to the debtor the accounts receivable will be debited with the sales accounts corresponding credit. It will include information about the amount of debt owed and should be segregated into groups according to the number of days since invoice. Accounts receivable are the liquid asset after the cash balance.

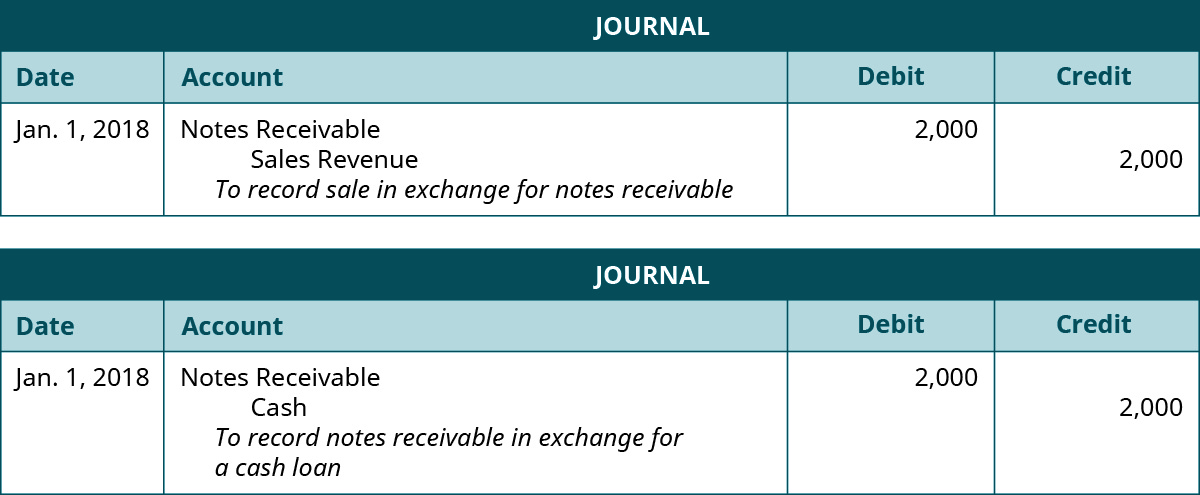

On most company balance sheets accounts receivable ledger items are recorded as an asset as the asset will convert to cash within one year. Notes Receivable Journal entry. Collecting accounts receivable that are in a companys accounting records will not affect the companys net income.

The accounts receivable turnover measures the a. Debit to Cash and a credit to Accounts Receivable C. Recording Accounts Receivable.

You use accounts receivable as part of accrual basis accounting. One depends on other. Recorded as Accounts Receivable Nonbanks are companies that offer financial products loans and services but arent chartered as banks.

Acctg 121 Trade And Other Receivables Pdf Bad Debt Balance Sheet

9 6 Explain How Notes Receivable And Accounts Receivable Differ Business Libretexts

Accounts Receivable Journal Entries Examples Bad Debt Allowance

Accounts Receivable Double Entry Bookkeeping

Solved 1 Journal Entry Worksheet A Record Accounts Chegg Com

Accounts Receivable Journal Entries Examples Bad Debt Allowance

Explain How Notes Receivable And Accounts Receivable Differ Principles Of Accounting Volume 1 Financial Accounting

At December 31 2019 House Co Reported The Following Information On Its Balance Sheet

On May 2 Mclain Company Lends 9 000 To Chang Inc Issuing A 6 Month 9 Not At The Maturity Date November 2 Chang Indicates That It Cannot Pay

Accounts Receivable Nonprofit Accounting Basics

Explain How Notes Receivable And Accounts Receivable Differ Principles Of Accounting Volume 1 Financial Accounting

Posting Komentar untuk "Collections Of Accounts Receivable Are Recorded In The"